Making Tax Digital (MTD) can often be a headache for accountancy firms when helping their clients make online tax submissions. Many businesses will not have the compatible software to make such submissions, leaving firms scratching their heads as they are left with no choice but to make manual data entries.

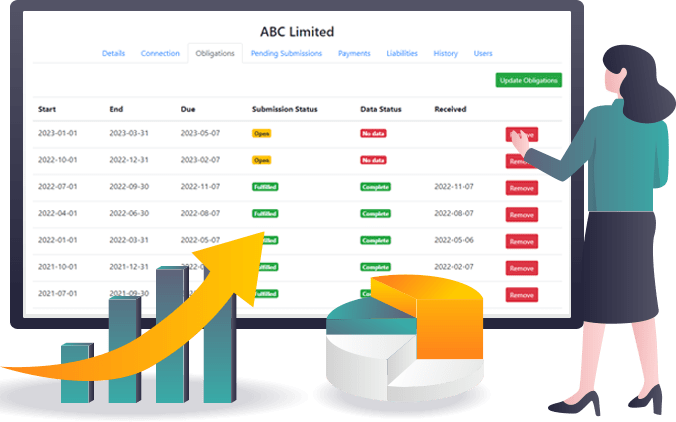

However, there is a solution. Summa Tech’s MTD bridging software can come to the aid of accountants and ensure a smooth transition between a client’s tax spreadsheet and the MTD portal, provided by HM Revenue & Customs (HMRC).

What can MTD bridging software offer?

Ease of transition

MTD bridging software can integrate with a range of existing accounting systems, making the transition to MTD smoother for clients. The software allows for easy import of data from spreadsheets and other non-MTD-compliant systems, reducing the burden of data migration.

Compliance assurance

Our bridging software will automatically check for errors in the data before submission, helping to ensure accuracy and compliance. The software helps in maintaining digital records as required by MTD regulations, aiding in compliance.

Efficiency and productivity

Bridging software will automate repetitive tasks such as data entry, saving time and reducing the risk of errors. It will also streamline the tax preparation and submission process, making it quicker and more efficient.

Cost-effective

By ensuring compliance with MTD regulations, bridging software helps clients avoid penalties for non-compliance. Bridging software is also a more affordable solution for clients who are not ready to invest in a full MTD-compliant accounting system.

If your accountancy firm is in need of a tool that will help you with clients who don’t have MTD-compliant software, then our MTD bridging tool is perfect for you. Contact us today for a free demo.